Subservicing you can count on.

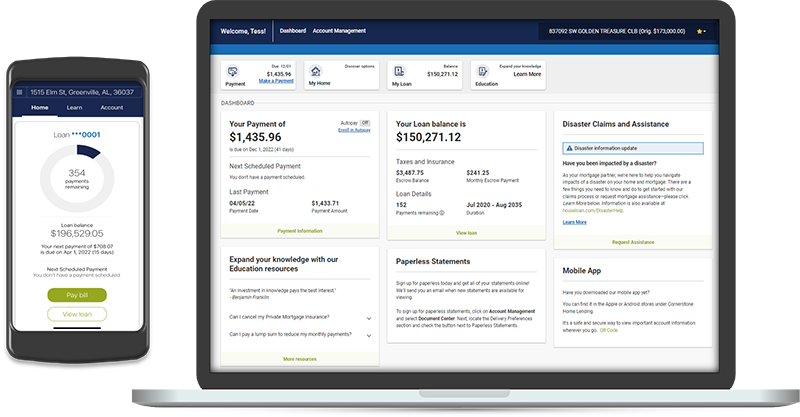

Our customizable servicing solutions are built to empower smart homeownership, minimize delinquency, deepen customer loyalty, and elevate financial performance.

Learn more

Our Formula

As a subservicing partner, we help third-party lenders and investors of all shapes and sizes elevate the life-of-the-loan experience. The result? Healthy mortgages, better retention, and a stronger financial performance.

- Available, responsive, and knowledgeable.

- Optimized for complete, one-touch resolution.

- Feedback loop to keep homeowners informed on open requests.

- Dedicated support team for your loan officers and other internal stakeholders.

Flexible & Scalable

Our robust platform is built to meet the individual needs of any lender and investor.

- Private label solutions designed to deepen loyalty to your brand

- Retention program with multiple avenues for lead generation

- Complete, end-to-end subservicing packages

- Interim servicing and component servicing options available

- Ability to handle draws

Variety of Products

We service a range of loan types, with agility to support the latest products in the marketplace.

- First and second lien mortgages

- HELOC, HEi, and closed-end seconds

- Non-QM (residential and business purpose)

- Construction and bridge loans